Frequent changes in policies and calculation logic make the workload of IIT declaration heavy;

Information between enterprise IIT declaration system and tax administration system are not shared;

The system of payroll outsourcing supplier can’t calculate the income tax by cumulative withholding method in time after the tax reform.

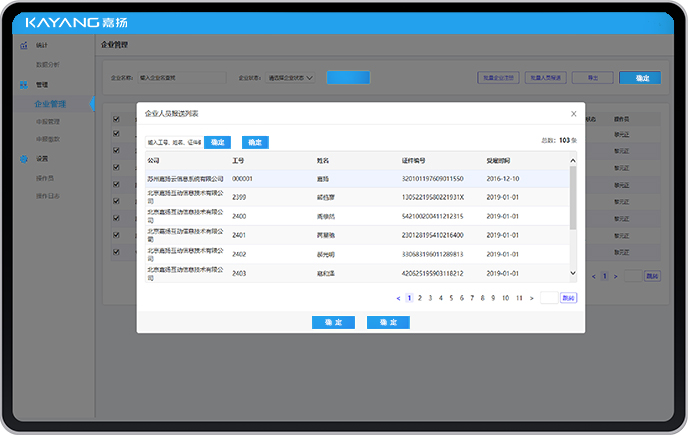

For group enterprises with hundreds of legal entities, the tax declaration has to be confirmed repeatedly in different systems for each legal entity which brings repeatable workloads and lowers the work efficiency.

Centrally manage multiply regions

Available nationwide without installing several tax payment systems for different regions.

Multiply tax IDs

Declare by department; support multiple tax IDs.

Accuracy

Declare the tax amount using monthly IIT payable amount thereby ensuring they are same without any tax refund or repayment.

Auto-obtain the special expense deductions

Auto-obtain the accumulative amount of special expense deduction items submitted in IIT app (taxation bureau-individual) for salary calculation.

Auto-pay & payment voucher

Can confirm the tripartite agreement and tax payable before the payment; the payment voucher and tax paid certificate is provided after the payment.

Understand the policy passively; have to adjust the rules from time to time; always lag behind;

Switch back and forth between tax bureau system and payroll system, and the workload is large;

Prone to errors due to multiply factors such as employee turnover, cumulative quota, rule adjustment, special expense deductions and payment types.

After the tax is calculated in payroll system, have to compare the tax amount with the result of the tax bureau system;

Find differences: if an error occurs when filling the tax returns, it has to be corrected till next month;

Confirm repeatedly in different systems; a lot of repeated workloads and low efficiency.

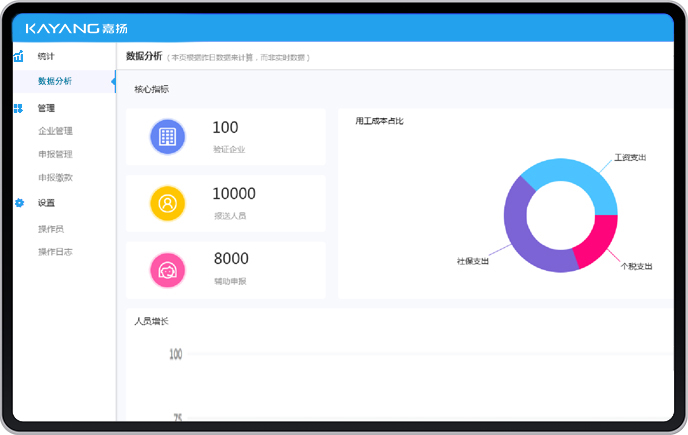

Auto sync personnel information and the latest accounting rules;

Auto obtain the cumulative amount of special expense deduction;

Update the IIT accounting logic synchronously to ensure accuracy;

IIT result is shown in detail; what you see is what you will get.

Reduce the workloads of HR and Finance Department;

Reporting Center-Customize reports including organization structure report, BI report configuration, and report design.

Reporting Center-Customize reports including organization structure report, BI report configuration, and report design.

如欲了解更多解决方案详细内容

请在线申请演示

Copyright © 2020上海鼎点注册信息系统有限公司 All Rights Reserved. 网站地图